north dakota sales tax rate 2021

The minimum combined 2022 sales tax rate for Charlotte North Carolina is. Download sales tax lookup tool.

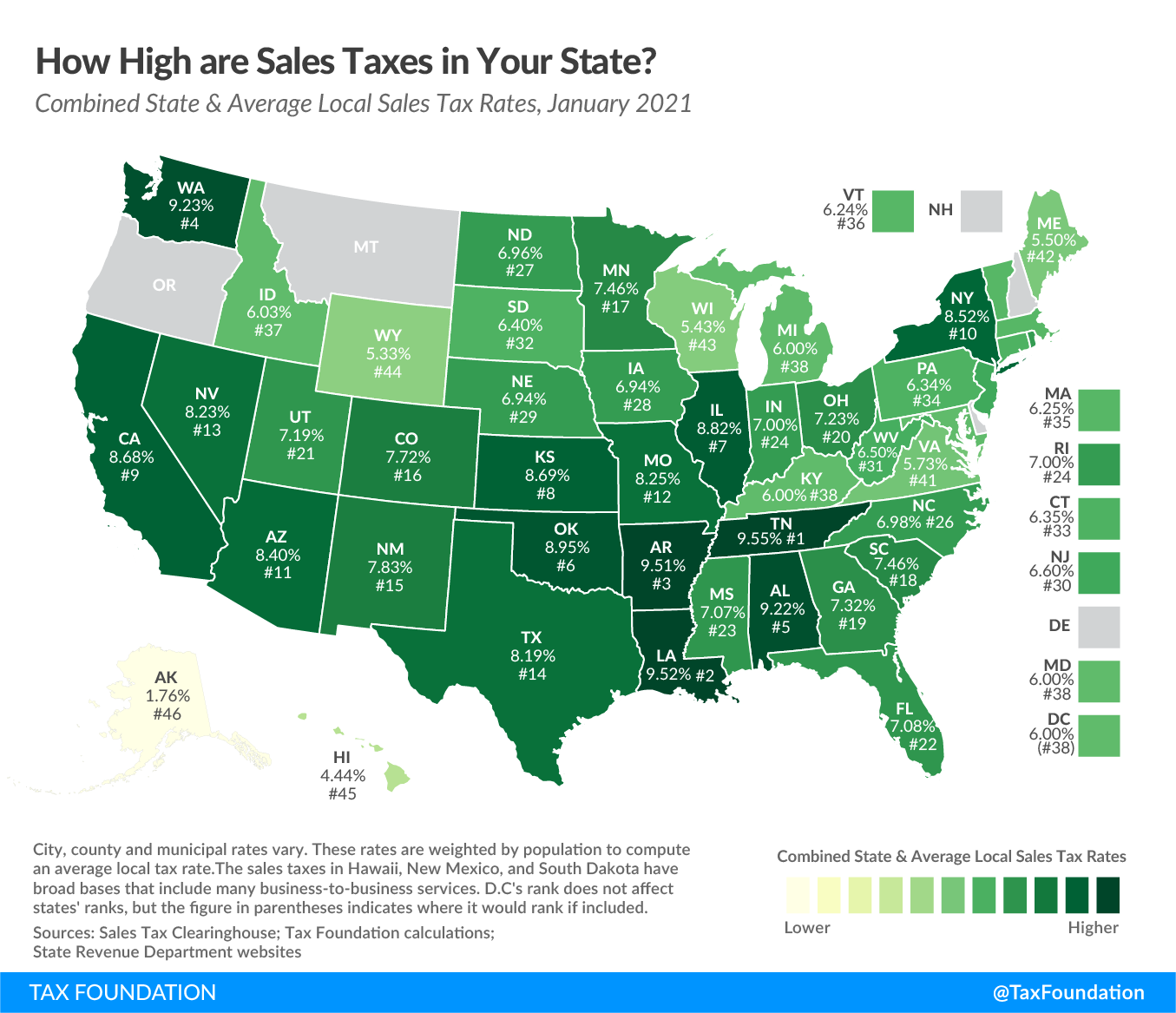

Mapsontheweb Infographic Map Map Sales Tax

Find your North Carolina combined state and local tax rate.

. North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222 on top of the state tax. Tax Commissioner Advises Taxpayers on 2022 Tax Season. North Carolina has 1012 special sales tax jurisdictions with local sales taxes in.

Combined with the state sales tax the highest sales tax rate in North Dakota is 85 in the city. The minimum combined 2022 sales tax rate for Denver Colorado is. Wayfair Inc affect North Carolina.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. North Dakota has recent rate changes Thu Jul 01 2021. State except neighboring South Dakota has had a higher unemployment rate during that period.

The 2018 United States Supreme Court decision in South Dakota v. The sales tax in North Dakota is 5 for most items. Look up 2022 sales tax rates for Charlotte North Carolina and surrounding areas.

Prescription Drugs are exempt from the North Carolina sales tax. Colorado has 560 special sales tax jurisdictions with local sales taxes in. All you need to do is enter your state and your city or county to find the right rate for you.

The sales tax is paid by the purchaser and collected by the seller. The state sales tax rate in North Dakota is 5000. Local tax rates in North Carolina range from 0 to 275 making the sales tax range in North Carolina 475 to 75.

This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax. North Dakota has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 3There are a total of 213 local tax jurisdictions across the state collecting an average local tax of 0959. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

North Dakota imposes a sales tax on retail sales. Has impacted many state nexus laws and sales tax collection requirements. This is the total of state county and city sales tax rates.

With local taxes the total sales tax rate is between 5000 and 8500. This is the total of state county and city sales tax rates. Since 1976 the highest that North Dakotas unemployment rate has reached is just 62 recorded in 1983.

Groceries and prescription drugs are exempt from the Colorado sales tax. The 2018 United States Supreme Court decision in South Dakota. Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10.

North Dakota sales tax is comprised of 2 parts. North Carolina sales tax rates vary depending on which county and city youre in which can make finding the. Gross receipts tax is applied to sales of.

Wayfair Inc affect Colorado. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the third quarter of 2021 are up 121 compared to the same timeframe in 2020. Click here for a larger sales tax map or here for a sales tax table.

The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. Did South Dakota v. Sales tax total value of sale x sales tax rate.

Once you know the local sales tax rate for your area you can use the sales tax formula below to figure out how much to charge your customers on each sale. The base state sales tax rate in North Carolina is 475. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 75.

Select the North Dakota city from the list of popular cities below to. Did South Dakota v.

Sales Tax By State Is Saas Taxable Taxjar

Click On Any State In The Map Below For A Detailed Summary Of Taxes On Retirement Income Property And Purchases Retirement Income Income Tax Tax Free States

North Dakota Sales Tax Rates By City County 2022

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

States With Highest And Lowest Sales Tax Rates

How High Are Capital Gains Taxes In Your State Tax Foundation

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

State Income Tax Rates Highest Lowest 2021 Changes

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

How Is Tax Liability Calculated Common Tax Questions Answered

How Do State And Local Individual Income Taxes Work Tax Policy Center

9 States Without An Income Tax Income Tax Income Tax

Sales Tax Definition What Is A Sales Tax Tax Edu

.png)

States Sales Taxes On Software Tax Foundation

The Corporate Tax Component Of Our Index Measures Each State S Principal Tax On Business Activities Most States Levy A Corporat Business Tax Income Tax Income

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation